2024 Due Date For Calendar Year Partnership Tax Return – The tax deducted at source is paid to the credit of the government. 2. The interest, along with late filing fees, is paid to the credit of the government. 3. The TDS/TCS return is filed before the . The due date to file an updated Income Tax Return (ITR-U) for 2021-22 is declared as 31st March 2024. The Income Tax Department of India has tweeted to alert the taxpayers regarding the approaching .

2024 Due Date For Calendar Year Partnership Tax Return

Source : carta.com

SKC & Company, LLC A Full Service Accounting Firm

Source : www.skcandco.com

Fiscal Year: What It Is and Advantages Over Calendar Year

Source : www.investopedia.com

US Tax Deadlines for Expats, Businesses in 2024 Online Taxman

Source : onlinetaxman.com

What Is the Tax Year? Definition, When It Ends, and Types

Source : www.investopedia.com

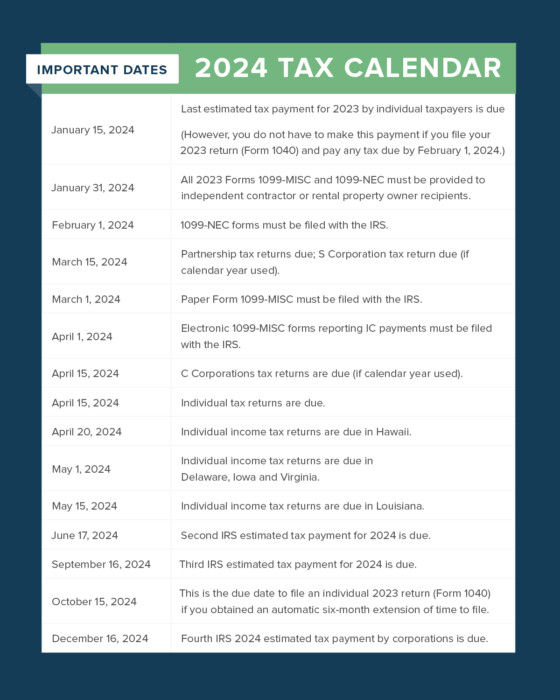

Tax Due Dates For 2024 (Including Estimated Taxes)

Source : thecollegeinvestor.com

Advocacy Week – Preservation Action

Source : preservationaction.org

2024 HR Compliance Calendar & Deadlines | GoCo.io

Source : www.goco.io

When To Expect My Tax Refund? The IRS Tax Refund Calendar 2024

Source : thecollegeinvestor.com

Property Management Tax Reporting Made Easy | Buildium

Source : www.buildium.com

2024 Due Date For Calendar Year Partnership Tax Return Business tax deadlines 2024: Corporations and LLCs | Carta: Meeting deadlines is a very important part of good tax planning. For this, a tax calendar may come in It is also the due date for third installment of advance tax for the assessment year 2024-25 . . Internal Revenue Service (IRS) responsibilities include assisting US taxpayers, conducting audits, verifying tax .

:max_bytes(150000):strip_icc()/FY-887c7c1cad1c47f38bd91db6e080b68e.jpg)

:max_bytes(150000):strip_icc()/taxyear.asp-final-8600d1dae2f845b795b6017fb894f431.jpg)